According to the International Monetary Fund (IMF)’s global economic outlook, based on its January 2021 report, most countries imposed stringent lockdown measures and as a result, the economic activities contracted dramatically on a global scale. The report says that although easing lockdowns can lead to a partial recovery, economic activity is likely to remain subdued until health risks abate. The salient feature of the said IMF report is quoted below.

“The global community will need to continue working closely to ensure adequate access to international liquidity for these countries. Where sovereign debt is unsustainable, eligible countries should work with creditors to restructure their debt under the Common Framework agreed by the G20.”

Sri Lanka is following a market-oriented economy with state guidance, involving some controls and restrictions and one could argue that such a framework would not be successful under a typical IMF programme. IMF programmes in general will essentially impose some conditions such as; maintaining fiscal discipline – not to exceed the government budget deficit beyond say 8-9 % of GDP, not to defend external value of the rupee, meaning not allowing the rupee to depreciate by pumping dollars from the official reserves of the Central Bank, not to go for unnecessary commercial foreign borrowings, etc. On the other hand, the global pandemic situation demands IMF and other multilateral financial institutions to adopt a more flexible attitude towards emerging economies to overcome this global recession. The writers’ own view is Sri Lanka could ask for a debt restructuring as stated in the IMF report.

Managing in turbulent times

The positive feature of working with IMF is that Sri Lanka’s credit rating could be improved and their banks and other financial institutions may be able to transact with foreign financial institutions efficiently and arrange trade finance facilities and commercial borrowings at competitive rates. Also, the Sri Lankan exporters may be able to receive foreign remittances without unnecessary delays and restrictions imposed by foreign correspondence banks. As for its credit rating position, Sri Lanka was downgraded four months back and at present, Sri Lanka is ranked “CCC grade”. When a country is under an IMF Standby Facility, there is a greater possibility of the ratings getting improved, thus building confidence among the business partners and foreign multilateral financial institutions like the World Bank, ADB (Asian Development Bank), JBIC (Japan Bank for International Co-operation), etc.

As articulated by the Central Bank Governor, the GoSL (Government of Sri Lanka) has been able to contain the trade deficit through stringent import control measures in order to save much-needed foreign exchange, as the tourism and travel sector and some exports areas such as the textile and garment sectors have been badly affected during the year under review. This is in the backdrop of some export targets where the government policymakers were expecting $ 4-5 billion per annum in terms of tourism proceeds before the Covid-19 pandemic hit. In fact, the Sri Lankan economy could realise only $ 0.9 billion from tourism in 2020.

Nevertheless, the Central Bank has been able to provide guidance, support, and advice to the Government to manage the macroeconomic fundamentals quite efficiently during these turbulent times, which is commendable. According to the IMF’s latest world economic outlook GDP (gross domestic product) growth rates, except China, whose GDP is 2.3% positive, all other countries have recorded negative GDPs, such as advanced economies India (-8%), US (-3.4%), Japan (-5.5%), etc. According to the IMF, China has been a bright spot in its continued fight against poverty. Sri Lanka has been able to contain the negative growth in 2020, which is in terms of GDP was only -3.7% as per Central Bank and Census and Statistics Department projections.

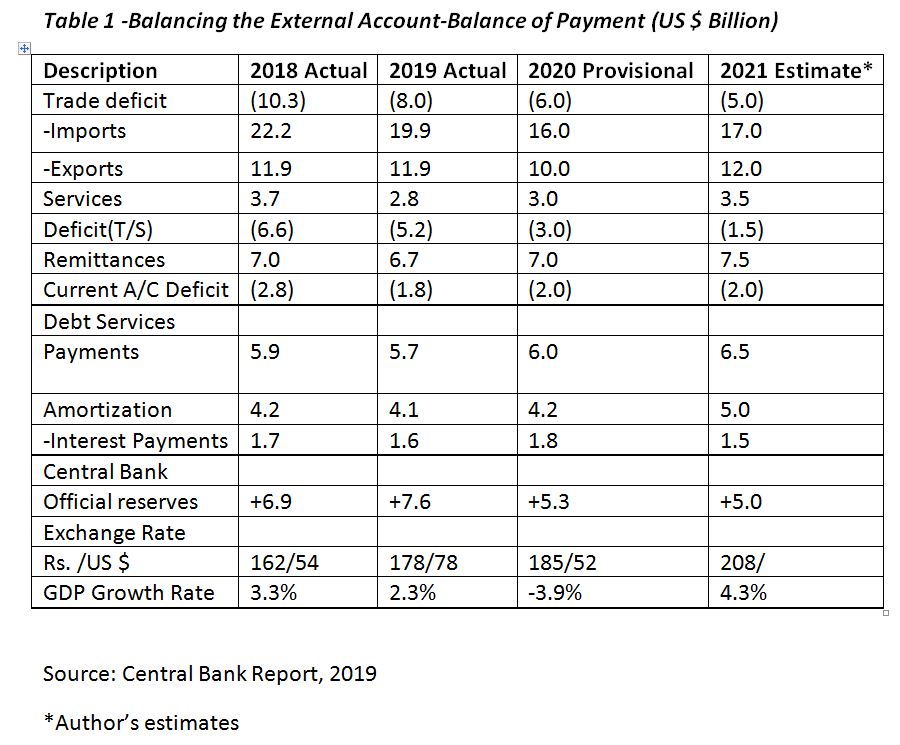

Table 1 shows the summary of the vital statistics of Sri Lanka’s macroeconomic transactions with the rest of the world. An attempt has been made by the writer to make some provisional figures and estimates to ascertain whether the Sri Lankan economy could withstand the pressure from this global economic downturn. Also, it is important to critically review the efficacy and effectiveness of the economic policy changes contemplated by the present government policymakers and to what extent they succeed in confronting capitalist economic system in today’s context.

As can be seen, the biggest challenge is in the management of the debt repayment capacity, especially in view of the fact that a total sum of $ 6 billion is due during the current year, which is the highest-ever debt service figure that the country has to service in order to avoid sovereign default. In addition to the above, domestic forex debt repayments such as FCBU (Foreign Currency Banking Unit) and SLDB (Sri Lanka Development Bonds) amounting to $ 1.5 billion will also become due, however the Government may be able to successfully arrange foreign swaps from friendly countries’ multilateral financial institutions and central banks to meet any contingencies. It should be mentioned that the Central Bank of Sri Lanka is vested with the responsibility of the management of the public debt, in terms of Section 113 of the Monetary Law Act.

Table 1: Balancing the external account – Balance of Payment ($ billion)

Confronting capitalism

Throughout the world, economic growth has drastically slowed. Natural resources are exploited for short-term profits. Wealth is concentrated in the hands of a few. While there are a large number of children living in poverty, multinational ultra-rich elites tuck their money into tax heavens. As we all know, lockdowns impacted peoples’ ability to move across borders, but it doesn’t stop money flowing into tax havens around the world, as claimed by Forbes magazine.

Anna Zakrzewski, who leads Boston Consulting Group’s Global Wealth Management Division, did a detailed study which revealed that the economic shocks of the coronavirus have meant that offshore financial centres such as Switzerland are back to their old tricks: Banking peoples’ money away from their more risky homelands.

“Confronting Capitalism” by Philip Kotler published by the American Management Association explains 14 major problems undermining capitalism and offers real solutions for a troubled economic system. Although best known as a marketing guru, Kotler trained as an economist under three Nobel Prize- winning economists, namely Prof. Milton Friedman who represented free market economic thinking, and two other professors, Paul Samuelson and Robert Solow of MIT. Some of the serious shortcomings of capitalism as articulated by Kotler include: tends to focus narrowly on GDP (gross domestic product) growth, generates income and wealth inequality, proposes no solution to persisting poverty, exploits natural resources and environment in the absence of regulations, favours short-term profits over long-run investment planning, fails to pay a living wage, and others.

New economic and business model for tea plantations

This reminds me of the Sri Lankan tea plantation-RPC (regional plantation company) model introduced in 1995, where some 88,000 hectares of cultivated tea estates have been transferred to 20 RPCs under 53-year lease periods with only one golden share retained by the Government, expecting the companies to put in much-needed investments in re/new planting, infilling of tea, optimum utilisation of arable agricultural land and other resources including factory modernisation, tea marketing efforts and other viable diversification options, improve labour management relations through collective bargaining process, etc. As per the latest statistics of the Tea Board, the total tea production at RPC level has come down to 70.6 million of its own crops and bought leaf of 24.2 million kg totalling only 94.8 million kg in 2020 (total national production in 2020 was 278 million kg – 34% RPC share) from the 135.3 million kg in 1995 where the total national production was as 246 million kg – 55% RPC share.

In January 2019, the daily wage was revised to Rs. 750 per day under the main collective agreement entered into between the RPCs and worker trade unions in 2003. Unfortunately, the daily attendance allowance and the productivity-linked wage rates hitherto enjoyed by the workers have been taken out jointly by the parties to the Collective Agreement, which the undersigned, as a non-executive director attached to one of the RPCs, had made written representations in January 2019 itself to the EFC (Employees’ Federation of Ceylon) and the Negotiation Committee, thus expressing serious concerns. Thereafter, the demand for wage increases came even before the presidential election held in November 2019 from worker trade unions under the Collective Agreement generally to be negotiated once in two years only. The RPCs have called for a new hybrid wage structure focusing on a revenue-share model based on “three day” productivity-focused rates and three daily wage rates – a total package for the entire week for the estate workers. But this was not acceptable to the worker unions quoting the “six days work rule” and practical issues. An option favoured by the trade unions is to increase the basic wage which attracts not only EPF/ETF (Employees’ Provident Fund/Employees’ Trust Fund) payments, but even the other terminal benefits such as gratuity, holiday pay, etc. An “out-grower model”, where the workers are allocated small plots of land to grow their own tea to sell to the factories, was also suggested without much deliberation to study far-reaching implications.

In view of the deadlock, the Cabinet has decided to refer the demand of the Rs. 1,000 daily wage to the tea and rubber industry Wage Board for a decision and they have incorporated a sum of Rs. 900 together with a budgetary allowance of Rs. 100 to make Rs. 1,000 as minimum daily wage payable to the workers under the Wages Board Ordinance with effect from 5 March 2021. The writer has been a proponent of the collective bargaining process under the main Collective Agreement (CA) entered into in 2003. My own view is, once the wage anomaly is sorted out, it is expedient that the parties get back to the CA and honour the conditions in the said agreement in the best interest of the tea industry, thus maintaining good labour-management relations at estate level. The matter is in courts and a decision is expected soon.

Tea export earnings are getting trickled down to farmers

With annual export earnings of Rs. 230 billion, at the Colombo Tea Auction level, the tea prices have increased from Rs. 545 per kg of made tea in 2019 to Rs. 628 per kg for the full year 2020. Despite production decreases, which is the main concern today, the foreign exchange earnings have reached this level thanks to the FOB (free on board) price of tea improving from Rs. 822 per kg to Rs. 867 per kg in 2020, due to efforts by our tea exporters – supported by improved quality of the final product by growers and manufacturers and the “Ceylon Tea” promotional campaign. Consequently, the export earnings are getting trickled down to tea smallholders and, in fact, the farmers are receiving Rs. 90 per kg of their green leaf as against Rs. 79 per kg in 2019 on an average basis. The main thrust would be integrated quality and productivity. Contrary to media reports recently, the majority of RPCs have also been making profits during the year 2020 as per Colombo Stock Exchange filings on tea. Credit goes to all the stakeholders of the global tea value chain from our tea grower to Sri Lankan tea marketing companies.

The total tea production during the first two months up to end-February has increased to 45 million kg from 40 million kg. Tea export revenue from January to March 2021 has increased to Rs. 64 billion (provisional) compared to Rs. 49 billion during the same period in 2020. The FOB price per kg of tea has also increased from Rs. 826 to Rs. 920, an increase of Rs. 94 per kg. The average auction price during the period of January to March has improved from Rs. 595 to Rs. 649, thus trickling down the benefit of the foreign exchange earnings and the increased export price to tea growers and manufacturers. In fact, the FOB price of tea exports during the last year, in 2020, was Rs. 867 per kg, which is an increase of Rs. 45 per kg from the FOB price of Rs. 822 during the year 2019. The high standard of “Ceylon Tea” in terms of quality, the wellness factor associated with premium black teas offered by Sri Lankan exporters, and the global promotional campaign launched by the SLTB (Sri Lanka Tea Board) would have contributed to these gains realised by the Sri Lankan tea industry. The SLTB has commended all the stakeholders, including the exporters, brokers, manufacturers, and the tea growers in the entire global value chain, for these achievements.

Conclusion

The Sri Lankan tea industry is not just a business; it is a way of life for over 2.5 million people, and we need to protect and nurture nearly 500,000 small holders and 650 tea factories and 140,000 estate workers by encouraging tea exporters to really focus on promoting and marketing Ceylon Tea B2C (business-to-customer), in addition to B2B (business-to-business) tea exports. Discerning tea consumers the world over are paying premium prices for Ceylon Tea, due to promotional campaigns focused on the authenticity of the product based on sustainability credentials and the wellness factor associated with Ceylon Tea. It is in that context only that the recent wage increases should be viewed.

From the above it can be seen that the main stakeholders, namely the RPCs, the worker trade unions, and the Government have failed in working together to attain the mission set out at the time of the privatisation of tea plantations in 1992. After 29 years of the first privatisation, it has now become necessary to migrate into a new economic and business model for RPCs, thus promoting high-quality plantations, and focus more on sustainable agricultural and manufacturing practices through infusion of increased investments and management inputs. Nevertheless, the success depends on our ability to market and promote Ceylon Tea in global target markets as a premium-quality beverage under the “sustainable food” category. As Mahatma Gandhi said, the difference between what we are doing and what we are capable of doing would solve most of the world’s problems.

Chairman – Sri Lanka Tea Board